Trading Psychology Masterclass

A 50-minute training covering 3 key principles of unbreakable trading psychology

Resolve Emotion-Driven Trading Using: Principle #1

Stop Over-Focusing on the PnL Using: Principle #2

Recover Easily After Losses Using: Principle #3

Welcome to this training. Today we’re diving into tactical trading psychology, or more specifically, how you can apply performance psychology principles to your trading to build a razor sharp mental edge. We’re talking about how to become clinically effective in executing your trading plan every time that you sit in front of the screens. But this isn’t just theory. We’ll be talking about real-world case studies of traders who use these principles to overcome challenges like FOMO, revenge trading, trading on tilts, and exiting winning trades too early, and how these changes led to measurable gains in execution and profitability.

I’m Créde Sheehy-Kelly. I’m a high performance and trading psychologist chartered with the Psychological Society of Ireland, and I’ve been coaching world leaders in business, finance, trading, and elite sport since 2007. This video stands alone as a valuable resource, but it also builds on and complements the principles that I’ve shared in my published chapters on mastering trading psychology. So if you’ve already read that material, then this training will take things deeper, showing you exactly how to put those insights into practice to create tangible shifts in your trading performance. Everything that we cover here today is drawn from my proprietary, Go Deep to Level Up® mental conditioning system, which I’ll talk about in more detail in just a minute.

One quick disclaimer before we start. This training is not financial, technical trading, investment or mental health advice. The case studies featured are for educational purposes only, and the results shown are not typical or guaranteed. And with that out of the way, let’s dive in. Let’s get clear on who this training is for so that you know that you’re in the right place. I don’t want to waste anybody’s time. You’re in the right place if you’re an experienced trader with solid technical skills and a proven strategy. Trading is your chosen career and you strive to consistently make salary level income from it. You know exactly what to do to hit get that level of profitability. But when the pressure is on, you’re just not executing as planned. You’ve read Mark Douglas, you’re convinced that psychology is absolutely critical for your trading, but it’s still not coming together for you and it’s costing you money. Every time that you leave profit on the table when you exit a winning trade too soon. Every time that you impulsively jump into a low quality setup and every time that you wipe out days or weeks of progress with one massive red day.

But this training is not for you if you’re still building basic technical skills or if you don’t yet have a proven defined strategy. If that’s the case, focus on those elements first and come back to the psychology after that. This training is not for you if you’re treating trading like gambling, a hobby, or a shortcut to fast wealth. And this training is not for you if you’re not prepared to actually show up and put in the work required to master your craft and get the results that you want. If you’re still with me, then excellent. That tells me that you’re serious about leveling up your trading and that you’re in a position to truly benefit from what I’m sharing here today. Here’s what we’re going to accomplish in this training. Number one, take the fluff out of trading psychology. You’ll see that trading psychology isn’t just some vague abstract idea. It can be practical, structured and actionable when you know how to apply it to get results. Number two, I’m going to show you how this works in the real world. I’m not just here giving surface level advice like trade higher time frames or hide your PnL.

I’ll walk you through three case studies of real traders who used my trading psychology system to eliminate costly habits and to achieve measurable returns. Number three, I want to inspire you to take action because trading psychology is useless unless you apply it. By the end of this video, you will be motivated and equipped to start closing the gap on where you are now and where you want to be. Before we go any further, let’s address one core question, what is trading psychology really? And the phrase alone is probably enough to spark some familiar ideas like composure, concentration, focus, resilience, risk management. And yes, each of those factors is important, but each of those factors is only one jigsaw puzzle piece in the overall jigsaw of your trading mental edge. It’s not the full picture. One of the biggest mistakes that I see many traders and trading educators make is minimizing what it takes to improve the execution of your trading plan from a psychology perspective. Yes, they talk about mindset and emotions and discipline and emotional control, but they’re largely missing the point. To achieve consistent, precise execution of your plan under pressure, it takes working on your fundamental human psychology.

It requires deep person-level transformation. And many mindset coaches are just not equipped to facilitate that. The advice goes something like this: struggling with revenge trading, just hide your PnL and focus on win rate instead. Overtrading, try a meditation app. Cracking under pressure, just trade higher time frames and reduce your position size. Sounds familiar, right? On the surface, this advice seems helpful, but in reality, it’s like trying to heal a broken leg with a bandaid. Most trading coaches are probably equipped to help you with your trading strategy, but that doesn’t necessarily mean that they’re also experts in human psychology. Mastering yourself, that takes an entirely different skillset. The problem with these solutions is that they don’t deal with the root cause of the issue. They don’t account for the complex interplay of emotions, beliefs, and behavioral patterns that high performance actually demands. To truly excel and to consistently execute your trading plan under pressure, you need to stop thinking like a hobbyist using surface-level hacks and start thinking like an elite athlete engineering a complete mental edge. Not just solving problems, but optimizing every factor that can give you even a one % advantage. Think NFL-level conditioning, not weekend warrior self-help.

Let’s be honest, terms like mindset, emotional control, self-awareness, and even mental edge can seem vague and hard to pin down. That’s why I want to shift the focus from concepts to behaviors, because behaviors are measurable, observable, trainable. So before we go any further, let’s define the mental edge in clear, practical terms. The mental edge is the mindset and the emotional control that enables you to execute your trading plan exactly as you intended to on every trade. That’s it. Not just knowing what to do, but actually doing it, and especially under pressure. This is the Holy Grail for all traders of every level, from early stage to professional. And it’s where the rubber meets the road. It’s where psychology translates into performance and ultimately profit. But let’s talk about some hard truths that many traders haven’t bought into yet. The reason why even traders who are actively working to improve their mindset and their discipline still don’t see meaningful results. In trading, hard work doesn’t equal return on investment. In school, corporate life, university, the equation is simple. The harder you work, the more you are rewarded. But unfortunately, in trading, that logic simply doesn’t apply.

You could be the hardest working trader who’s read every trading psychology book in the library, who does four-hour trading reviews, who stays in front of the markets 24/7 and still not be profitable. If you’re working on the wrong things, then your performance and ultimately your profitability will never improve. Here’s the brutal truth. The market doesn’t care. It doesn’t care how hard you study the charts. It doesn’t care how late you stayed up doing your trading review. It doesn’t care how many videos you watched on YouTube in the name of trading education. It’s not even going to care that you’re watching this video training today. Sacrifice alone means nothing in this game. There are no gold stars for effort. The only thing that matters is how you perform under pressure. And the traders who consistently perform at their peak, they don’t rely on willpower or grind. They use systems, systems that train and support elite execution, systems that stack the odds in their favor, systems beat sacrifice every single time. But let’s be clear, systems alone aren’t enough. It only works if you work it. You have to apply the right actions and processes consistently and deliberately every day in your trading, just like someone trying to build a more muscular physique.

Just having a world-class personal training routine is not enough to pump up your biceps and sculpt your abs. It’s the consistent implementation of that routine, putting it into practice every day, every week in the gym that creates the muscle gain. That’s what produces real lasting transformation. Not information, not intention, implementation, day in, day out. This is exactly why I created Go Deep to Level Up Your Trading™. This is my proprietary mental conditioning system designed specifically for traders who want to develop an unbreakable mental edge. After coaching thousands of top performers, the patterns became clear to me, and I distilled my entire high performance coaching method into a structured, scalable system for traders at every level. When you work through the system, you gain the tools, the knowledge, and the blueprint to create your own world-class, personalized mental training routine. And then it’s the consistent implementation of this routine day in, day out that leads to measurable improvements in performance, pressure proof execution, and an unshakable mental edge. We’ll be selecting three of the key principles from the Go Deep to Level Up Your Trading™ system in just a minute and exploring real world case studies of how traders put these into practice.

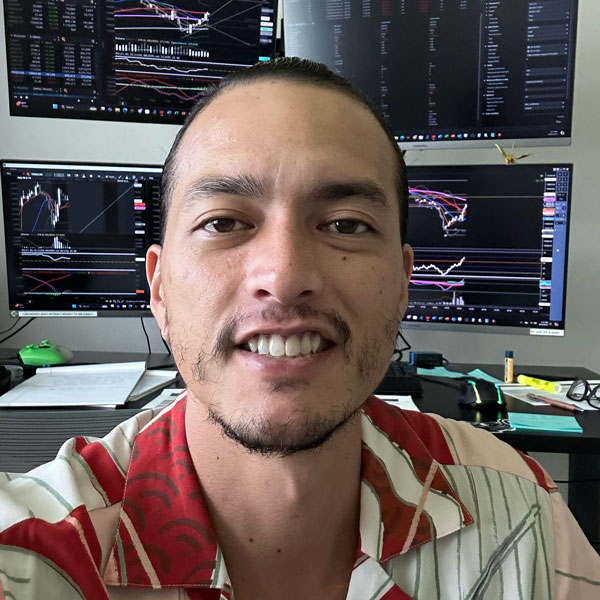

But first, let me introduce myself properly. I’m going to tell you who I am and why you should listen to me if you want to sharpen your trading mental edge. I’m Créde. I’m a high performance and trading psychologist chartered with the Psychological Society of Ireland. Since 2007, I’ve been supporting top performers in business, trading, finance, and professional sports. People in high takes environments where split second decisions can make or break a career. I help performers like you to identify and overcome the limiting beliefs, the destructive habits, and the subconscious patterns that are holding you back from success. I help you to excel under pressure, to unlock your full capacity, and to turn your potential into real life tangible rewards. In terms of credentials, I have a BA in psychology and a first class Masters in sport and exercise psychology. And that photo you’re seeing, that’s me and my friend at our master’s graduation way back in 2009 in Wales. And yes, the university does look like something from Harry Potter. I’m also accredited by the Irish Sport and Exercise Sciences Association to provide sports psychology support to elite and Olympic athletes. But most relevant to what we’re talking about today, I’ve coached professional traders and hedge fund managers managing accounts into the multimillions to elevate their performance and reach higher levels of success.

This isn’t just theory for me. I’m not here to offer regurgitated textbook advice. I don’t teach anything that I haven’t also lived. I used the same tools and techniques that I teach today to help me overcome an eating disorder and depression in my early 20s. And I use these same tools and techniques to build a mental edge and a resilience to pressure that allowed me to do things like risk over 40 % of my entire networth during COVID in 2020 on an online business program to take my own business performance to the next level. I want you to understand that I truly believe in and embody everything I teach, and I’m here to help you do the same. Now, let’s get into the real-world application of this mental conditioning system. We’re going to explore three specific trading psychology principles that form the foundation of building a razor-sharp mental edge, and we’re going to bring them to life through the case studies of real traders that I’ve worked with. In my book with Andrew Aziz, I dive into seven core principles for building elite mental performance. But we’re going to laser focus on just three today so that you can get a powerful and practical taste of the mental edge in action.

Principle number one, program your subconscious mind for elite level discipline and consistency. Principle number two, prioritize the successful execution of your trading plan or your trade books or the PnL. And principle number three, become an expert in bouncing back after losses, setbacks, and mistakes. We’re starting with principle number one, program your subconscious mind for elite level discipline and consistency. Why is this principle important? Well, since you’ve been trading for a decent length of time, you already know how important it is to be able to execute your trading plan exactly as you intended to on every single trade, regardless of pressure, position sizing, market volatility, uncertain economic conditions, or being in a drawdown. This is the true mental edge that we’re talking about today. In reality, the technical side of trading is relatively straightforward to master. It’s the ability to master yourself that poses one of the biggest hurdles to significant trading success. If you want to excel as a consistently highly profitable trader, then discipline is an absolute must. But unfortunately, our emotions don’t always play ball. You’ve likely already experienced the havoc wreaked by emotions like fear, greed, anger, FOMO, impatience. And in In the midst of breaking your trading rules or succumbing to emotion-based trading, you’ve probably found yourself wishing that you could just trade like you had ice in your veins.

Become an absolute robot so that you can cut off from the emotions that are hijacking your trading and sabotaging your profits. Thinking that if you could do this, then you would be on track to elite level execution and the profits that result from that. And maybe you followed generic trading advice as to how to overcome this hurdle. The old way of trying to master trading psychology sounds a little like, reduce your position size, control your risk, double down on willpower, and just make sure you’re not trading from a place of anger, greed, or FOMO. But all these well intentioned suggestions still require you to battle internal resistance to stick to your trading plan, and that’s a losing game. But what if I told you that just seeking to manage those emotions and the impact on your trading is not going to bring you the consistent profitability that you want? The truth is, with the right tools, you won’t even feel any fear, anxiety, FOMO, rage or greed. You won’t need to manage those emotions because when you address the root cause of them, they don’t even arise in the first place. Willpower is no longer required.

You can feel calm and composed in the market and stick effortlessly to your trading plan on every single trade. Tom Winterstein was a client of mine who was struggling with breaking his trading rules. He was engaging in overtrading and he had an all or nothing mentality. Now, Tom was a technically skilled trader. He had been trading for 20 years, so he absolutely knew what to do from a technical perspective to make money in the market. But his trading had reached a plateau. He felt he just wasn’t hitting that level of consistency and profitability that he was truly capable of. His bad trading habits were costing him money, and he couldn’t quite figure out how to fix it. Now, Tom was no stranger to trading psychology. He’s a certified mental performance coach and a trading educator. So he was already bought into the idea that working on your mindset can improve your trading results. But it turned out the piece that he hadn’t cracked yet was getting right down to the the root cause of the subconscious beliefs that were creating the emotions that were causing him to impulsively break his trading rules. Tom took my Go Deep to Level Up Your Trading™ program.

And with it, he was able to pinpoint the exact subconscious beliefs that were creating these highly charged emotions that were negatively impacting his trading. And like many traders who take this program, Tom realized that these blocks were rooted in issues that originally had nothing to do with trading, but they were now showing up in his trading performance. And this is really common. Having discovered what wasn’t working for him, Tom was able to use the tools and techniques within the Go Deep to Level Up Your Trading™ program to rewire his subconscious mind and his patterns for success. So let’s talk about Tom’s results. In the eight weeks after finishing the Go Deep to Level Up Your Trading™ program, Tom had a record trading week. This was the most money he had ever made in trading in a week in his entire 20-year trading career. And in the third month after finishing the program, Tom had a record trading month, the most money he’d ever made in a month in his entire 20 year trading career. And as a four months after completing the program, his top five all time trading weeks had been since completing the program, and he had had losing days, but no losing weeks.

And in Tom’s own words, I’ve had a long term goal to make more than $10,000 per week from trading. And for the first time in my entire trading career, the Go Deep to Level Up system has oriented me to achieve and surpass that goal. Not only that, Tom also found that his upgraded mindset had benefits for his relationships, his role as a father, and his spiritual life, too. So what was it that worked for Tom that goes against the standard trading psychology advice as to how to become more disciplined? Instead of just tackling the symptoms of the issue, trying to reduce the intensity of the emotions by tweaking his trading strategy, Tom dealt with the issue at the root, the subconscious beliefs that were creating the highly charged emotions that were causing him to break his rules in the first place. So here is the new way of doing things. You don’t actually need more will power or to change your strategy to become a more disciplined trader. You just need to reprogram your subconscious mind for success. This is the part of your mind that holds your deepest memories and beliefs and that rules 95 % of your behavior.

If your subconscious beliefs supports your trading goals instead of thwarting them, then you won’t feel any anxiety, FOMO, greed, fear, or rage. It’s not a matter of trying to reduce the intensity of the emotions by tweaking your strategy, because the emotions won’t even arise in the first place. And And this frees you up to trade how you really want to while fully trusting yourself to stick to your trading plan. Like I said, your subconscious mind rules 95 % of your actions. So if you have a subconscious belief that says, I never have enough money, then that might cause you to feel greed while trading and lead you to staying in a losing trade too long. Or let me give you another example. If you have a belief in your subconscious mind that a loss means that I’m a failure, well, then that’s going to be in the driver’s seat when you’re trading. Cue revenge trading when you take a series of losses because suddenly it’s no longer just PnL on the line, it’s also your self-worth. So in actual fact, whenever you feel yourself in the grip of strong emotions like FOMO, greed, anxiety or rage, and this is causing you to impulsively break your trading rules, what’s happening is that your subconscious mind has taken over the driving seat.

Strong emotions are not the reason why you’re breaking your trading rules. They are just the red flashing warning lights letting you know that your subconscious mind has taken over your trading and that your conscious mind is powerless to stop it. Think of this like a Lamborghini car. One day you take your car out for a spin and you see a red flashing warning light on the dashboard telling you there’s something wrong with your engine. And you realize that you’ve just filled your gasoline car with diesel. Disaster. Now, you could try and deal with the annoying warning light. You could try and change the color of it so it’s less irritating. You could try and change the destination of your journey to somewhere closer so that you don’t have to put up with it so long. Or you could just deal with the real cause at the root that’s going to take your car off the road if you don’t address it. So you take your car to a mechanic, they work their magic, and they replace the diesel for gasoline, and you’re back on the road en route to your original destination. Think of your conscious mind as the driver of the car.

You know exactly where you want to get to with your trading, and you’re doing everything in your power to get there. But you do need gas in the tank in order to be able to drive the car. Your subconscious beliefs are like the gas in the tank of the Lamborghini. They literally fuel your actions. But if you fill your tank with a wrong type of beliefs, subconscious limiting beliefs that thwart success, well, then you’re never going to make it to your destination, your long term trading goals. Strong emotions like fear, greed, anxiety, rage and impatience are nothing more than red flashing warning lights. They wouldn’t be triggered if the right gas was in the tank. So when you find yourself with a highly charged emotion that’s causing you to break your trading rules, it’s just bringing your attention to a deeper issue that needs to be resolved. If you can reprogram the beliefs that are causing the greed, fear, impatience, FOMO, well, then you can overcome any destructive trading habits and achieve elite level discipline and consistency. Now, this might sound unlikely for you. You might be sitting there thinking, yeah, sure, that applies to people with messed up childhoods, but it doesn’t apply to me.

Well, think back to the last time that you broke your trading rules and think of the emotion that you were feeling just before you actually broke them. Yes, that was your subconscious mind at play. In my experience, helping thousands of traders to improve discipline, execution, consistency and profitability, this is one of the most crucial aspects of your mental edge to address if you want long term success. Remember, willpower will never cut it. Trying to rely on willpower to stick to your trading rules is like trying to beat back a tidal wave with a frying pan. So if you want to achieve 100 % discipline in your trading and elite level execution, here’s what you need to do. You need to get into the arena with your subconscious mind. How? By following this proven framework just like Tom did. First, identify what destructive habits are costing you money in your trading. Next, identify what emotions are causing you to deviate from your trading plan. So what are the red flashing warning lights that you associate with breaking your trading rules? Then pinpoint the specific subconscious beliefs that are being triggered by the market and that are causing these emotions to arise in the first place.

And finally, when you have full clarity and understanding around that pathway, then you want to reprogram your subconscious mind with the beliefs that will carry you to success. Now, I’ve run through that quite quickly and it seems simple and straightforward, and it can be, but there is a lot of depth involved in each of those steps. But if we work together in my Go Deep to Level Up Your Trading™ program, you’ll be able to complete that whole process within the eight weeks of the program. We actually dedicate two full modules to this topic because it’s so critical for your trading success. Okay, so maybe your BS meter is being activated right now and you’re thinking, Sure, Créde, it sounds great, but I’ve been plagued with these challenges for years. How is it really possible to identify, decode, and resolve these beliefs in as little as eight weeks. Well, I don’t expect you to just take my word for that. And so I’m highlighting the experience of Lisa Alden, one of the traders who took the Go Deep to Level Up Your Trading program and said the growth it offered me as a person outside of trading rivals any therapy that I’ve had in the past 20 years.

So how is it possible to use a generalized proprietary framework to pinpoint the exact personalized beliefs that are holding you back in your trading? Let me explain. Since 2007, I have been immersed in the subconscious minds of high achievers and elite performers. And since 2019, I have been almost exclusively working with traders in one to one, group, webinar, and program formats. That is a lot of people’s limiting beliefs and emotional baggage that I have been privileged enough to bear witness to. And while we would all love to think that we’re utterly unique, it turns out that the human psyche is actually quite predictable in a number of ways, especially when it comes to predicting how our subconscious limiting beliefs can trip us up in our day to day lives. What I saw is that 99.99% of all trading psychology challenges boil down to the same few costly actions in the market. And while you might think that your issue is FOMO or rage or impatience, They’re actually emotions. They are not the actions that are costing you money in the market. If you think about it, greed might cause you to stay in a losing trade too long, or FOMO might cause you to jump into subpar setups.

Those setups that don’t fit your A+ setup criteria. But those are the actions that are costing you the money. So it’s pretty straightforward, really. There are only a certain number of ways that you can actually break your trading rules. Remember how we talked about how 95 % of your conscious actions are driven by your subconscious mind? Well, it turns out that 99. 99 % of all trading psychology challenges boil down to a small number of the same few limiting subconscious programs and beliefs. So you might feel that you’re the only trader in the world who can’t get it together enough to stick to a daily loss limit. But the chances are there are a zillion other traders doing the exact same thing. But what’s really fascinating is that all of these traders’ destructive habits are likely being driven by the same small number of subconscious limiting programs and beliefs. So what the Go Deep to Level Up Your Trading™ system does is it profiles every single one of these trading psychology challenges against the subconscious limiting beliefs and programs that are driving the behavior. Then it gives you the mental training tools to actually reprogram any of these subconscious beliefs that are not serving you.

And trust me, this is the quickest path through your psyche right to the root of your trading psychology challenges that you’re ever going to find. It helps you to put a permanent end to destructive habits in your trading without putting on Celine Dion songs and wandering around in your psyche for hours on end searching for answers and without wasting time on unproductive naval gazing. Now, don’t get me wrong, self-awareness and self-reflection are really important aspects of the mental edge. But if you’re trying to do this with no roadmap, then it’s going to unnecessarily cost you time, cost you emotional capital, and likely even cost you money in the market. This system gives you the instruction manual to your subconscious mind and helps you solve your trading psychology challenges faster than Sherlock Holmes on a good day. So let’s recap principle number one. The way to achieve 100 % discipline in your trading is by using a system to decode and reprogram the subconscious beliefs and blocks that are hijacking your trading when the pressure is on. And just like Tom experienced, this transformation can happen in a matter of weeks. No willpower or endless hours more practice in the market required.

And that takes us to principle number two, prioritize the successful execution of your trading plan or your trade books over the PnL. Why is this principle important? Well, if we’re being honest, most people get into trading to make money. And what you might want to spend that money on could vary wildly from trader to trader. But I’m in the business of high performance. And if you’re putting a huge effort into mastering the craft of trading, you’re likely going to want to see a large profitable return on your efforts. And that’s fair enough. As a trading psychology consultant, I want you to make money. The more money you make, the more I have succeeded in my role. But the completely counterintuitive thing about trading is, if you focus on the PnL at the wrong time or if you give it more priority than actually executing your trading plan, you’re going to end up self-sabotaging. You will prime the exact behaviors that will cause you to break your trading rules, give back profits, make mistakes and leave profit on the table. Now, to be very clear, I am not saying that you shouldn’t have profit targets, set stops, have daily loss limits, or any of those other strategic aspects of your plan.

What I’m specifically talking about is what’s taking jazz hands center stage in your focus and awareness when you’re in the middle of a trade. Let’s talk about the old way of thinking that the PnL is the best measure of success on a trade to trade and day to day basis. If you’re somebody that focuses heavily on the PnL, you’re likely going to be able to empathize with the following scenarios. You set daily profit targets, and when you hit them, you feel great. You feel validated as a trader and as a person. You feel confident and like you’re making excellent progress, and you’re happy and proud to share these trades with the people on your desk, in the chat room, or on social media. But when you’re trading and your PnL takes a hit, you suffer a loss, a string of losses, a red day, or a string of red days, it affects your mood, it affects your emotions, and it affects your decision making. And suddenly the PnL is the single biggest factor determining your actions on the next trade. What’s happening is that you’re trading reactively instead of proactively. The tail is wagging the dog.

And if you really sit down and think about it, most trading psychology challenges can be traced right back to an over focus on the PnL. Reacting to a loss or a string of losses by trying to trade yourself out of the red, that’s taking action based on the PnL. Jumping out of a winning trade too early because you’re afraid of giving back unrealized gains, that’s taking action based on the PnL. And FOMOing into low quality, low probability trades because you’re afraid of missing out on an opportunity to make bank. That’s taking action based on the PnL. The more attached that you are to the PnL or the outcome while you’re trading, the more likely it is that you’re going to break your rules and deviate from your trading plan. And if you’re someone who regularly finds yourself making decisions and taking actions based on the PnL, you likely already have the cold, hard evidence from your trading that this doesn’t work. It’s going to show up in the long term as inconsistency in your trading. Einstein said the definition of insanity is doing the same thing over and over again and expecting different results. The thinking that got you this far in your trading will not be the same thinking that gets you to your long term trading goals.

But I get why you might think that it would. I totally understand why prioritizing the PnL might seem like the best way to make money when you’re trading. It makes logical sense to focus on the money, when making money is your goal. In the short term, making money can make you feel like you’re successful and winning, even if it’s at the expense of your trading plan. And then feeling like you’re winning makes you feel like you’re making progress. And that gives you that nice hit of dopamine and adrenaline in your brain that reinforces the behavior and keeps you stuck in the cycle. But this is the reason why it’s such a dangerous practice for your trading, because it sometimes works, but only ever in the short term. For example, let’s say that you’re trading and you’re down $6,000 for the day, and this is way past your daily loss limit of $4,000. So you trade yourself out of the red and you end up the day $2,000 in the green. You’ve snatched victory from the jaws of defeat. You feel elated and confident and skilled as a trader. And this is great. But then the next day, the same thing happens, but with a different outcome.

But for some reason on this day, you can’t turn it around. You’re not able to trade yourself out of the red. And so you end the day red, taking a huge, significant loss. And if you repeat this pattern over time and this cycle, what will happen is that, yes, the frequency of your red days might be lower than the frequency of your green days, but your losing days are going to far eclipse your winning days in terms of magnitude. It’s like a game of trading snakes and Ladders. You make forward progress, a few winning trades, a few winning days, only to hit a snake, a string of losses, one massive red day. And that sends you right back to where you started, a smaller trading account. Or, focusing too much on the PnL can create a very different scenario in your trading, one where you’re cautious about risking your money in the market. So you see your ideal setup appear, but you hesitate, you start doubting yourself and your strategy, and the trade goes without you. And in this case, your fear of losing money has actually stopped you from making any. When you’re taking actions in your trading that prioritize the PnL over your process or your trading plan, what you’re actually doing is trading short term success for long term failure.

This is exactly the issue that one of my clients Meleen Sheth was experiencing before we worked together. He was a skilled trader but had hit a wall with his progress. He was experiencing internal conflict every time that he took a trade, and this was preventing him from following his profiting process and causing him to exit trades too early. On the flip side, he was also struggling with revenge trading and over trading. So in essence, his emotions were driving a lot of his actions in the market. And so he was focusing on the PnL at the expense of following his trading process. So he came to the Go Deep to Level Up Your Trading program to fix this. And he experienced some pretty speedy results. Of course, we worked on the deeper subconscious piece and mindset blocks, but we also introduced a range of practical mental training tools to help Meleen authentically make that shift from considering success in terms of the PnL to actually buying into the idea of success being defined by the execution of his trading plan. And one of the techniques that really helped was setting goals based on his performance as opposed to the PnL or the outcome.

And then rigorously tracking his performance against these goals on a day to day and week to week basis. And in Meleen’s words, within six weeks of taking the program, his discipline sharpened substantially. In six weeks, he went from only 75 % of his trades meeting his set up criteria to 100 % of his trades meeting his set up criteria. And he also improved on following his trading process on only 61 % of trades to 93 % of trades in that same window. And he explained that these incremental improvements in performance had a direct impact on the size of his trading account. One of the key reasons why Meleen experienced such rapid results was his diligence in following the system. He trusted the process, he completed the modules in order, and he integrated each mental training tool into his routine before layering in the next one. His discipline in following the structured system resulted in improved discipline in sticking to his trading plan. But why is it that obsessing about the PnL is so detrimental for your trading? Well, it’s because if you’re doing this, then your mind frame, your decision making, and all of your actions are revolving around the PnL as opposed to the execution of your plan.

This is completely counterproductive, because if you think about it, the only way to be long term successful in trading, to be consistently profitable, is to focus on the execution of your plan on every single trade. If you focus on the process, the results will take care of themselves. Now, of course, I’ll caveat that statement and say that’s assuming that you have a statistically profitable and solid trading plan. The problem with exclusively focusing on the PnL when you’re trading is that it massively increases the pressure that you’re under. And there are a whole host of scientific theories that explain how pressure negatively impacts your cognition, so your decision making, your thinking. In trading, this can look like paralysis by analysis, where you hesitate and miss an entry, slowing down your thinking so you miss an entry or you’re late for exiting a trade, narrowing your attentional focus so that you miss key signals that the market is presenting you with, ironic effects that leads you to take the exact actions that you’re trying to avoid, maybe jumping out of a winning trade too soon, increasing the likelihood of mistakes, maybe fatfingering into a trade that you didn’t intend to get into, and of course, our all favorite, turning up the volume on those limiting subconscious beliefs that cause you to impulsively break your trading rules.

So you might be thinking, okay, I get it. I get why focusing on the process is better than focusing on the PnL. But that’s really easy to say and much harder to do in practice. And yes, I 100 % agree with you. But only if you’re not using the right tools and techniques to authentically make that shift to focussing on the execution of your trading plan as your default mode for trading. That’s why my Go Deep to Level Up Your Trading program contains over 35 practical trading psychology techniques to help you integrate and sustain these mindset shifts in the practical aspects of your trading, in the actions that you’re taking in the market. So let’s talk about the practical things that you can do. I’m sharing three techniques that you can use to stop obsessing about the PnL and to place a higher emphasis on the execution of your trading plan, just like Meleen was able to do before he even completed the program. Now, just before I share these strategies with you, I want to reemphasize that I am not saying that the PnL is not important for your trading. All I’m saying is that if you focus on it at the wrong time, then it can derail your performance.

So what are three actions that you can take to keep focused on the execution of your plan over the PnL? Number one, redefine success in trading. Reshape your definition of a green day or a green week to one where you followed your process to a T, and then anchor this in your daily review metrics. Hold yourself accountable to the successful execution of your trading plan, at least on a trade to trade on a day to day basis. Then you can track the outcome, so the PnL, on a weekly, monthly, quarterly, and annual basis. Because there plausibly could be a day where you do everything right. You follow your process to a T, but you still don’t make any money. Maybe the market conditions are bad. Maybe your opportunity isn’t there. The set-ups aren’t appearing. And so if you follow this definition of success, you still get to give yourself credit for having a green day. It’s a green process day. That way you can avoid the temptation of jumping into low-quality set-ups just because you feel an urgency to be taking action and placing trades to feel productive as a trader. Action number two for prioritizing your trading process over the PnL is effective goal setting.

Now, I’m not talking about SMART goals. Everybody’s heard of those. I’m talking about a new paradigm for goal setting that’s based on process, performance, and outcome goals, one that holds you accountable to the execution of your trading plan. So instead of setting a daily profit target or an outcome goal, you would set goals based on something that is entirely within your own control. So a good example of a performance goal is 90 % or more of all trades taken met my A plus set up criteria. This is such a fundamental aspect of your mental edge that I dedicate an entire module to it in the Go Deep to Level Up Your Trading program. And if you decide to take the program, I’ll guide you through creating an entire goal setting framework that makes it easy to ignore the PnL and that dissolves the urge to trade yourself out of the red or to second guess yourself on entries. One quick word of warning. Setting goals based on R values or win rates is just as outcome focused as setting goals based on the PnL. And the reason is that within each of these variables, there are factors that are completely outside of your control.

Market conditions can dictate whether you achieve these goals on any given day. And so you’re much better off to set performance-based goals like the one I just mentioned. The 90 % or higher of all trades taken met my A+ setup criteria. Because you can absolutely control whether you take a valid set up, but you can’t control how much profit that trade might deliver for you. And lastly, action three for prioritizing your process over the PnL is to reset to neutral after every trade. When you are acutely focused on the PnL, then you’re looking in the rear view mirror at all of the trades that went before, and you can’t be giving your full focus and attention to the road ahead, the next trade. You can use a whole range of techniques to get to the point where every trade that you take is a clean slate. And please note, this is an actual skill that you can learn and perfect. It’s not just a mindset, and it’s a crucial skill to learn if you want to stop sliding down those snakes and returning to where you started with a smaller trading account. Now, I’m aware I’m throwing a lot of information at you, and it probably sounds quite simple and straightforward on the surface, but I know from experience that the majority of traders are not implementing these concepts in their trading in a practical and concrete way.

In one short training video, it’s very challenging to talk through all of the tools and techniques that you can use to anchor these mindset shifts in your trading actions. But to give you even just two examples, in the Go Deep to Level Up Your Trading program, one of the very first exercises that you’ll complete is the trader performance profile. And if you complete this exercise in a really in-depth way, then you’ll be aware of all of the potential factors that you can work on in your trading that could improve your trading performance. And this in itself will help you to shift your focus away from the PnL. And I also give you a rapid reset meditation, which will help you instantly recover from any trading loss. The bottom line is that obsessing over the PnL and prioritizing this over the execution of your trading plan will give you short term success at the expense of a long term trading career. To achieve serious consistency and elite execution in your trading, you need to redefine what success is You need to set goals that hold you accountable to the execution of your trading plan over the PnL, and you need to master the skill of resetting to neutral after every trade.

And this is so much more than a shift in mindset. Using this goal setting framework and these practical trading psychology techniques will help you authentically shift into this new way of approaching your trading. So that was principle number two, prioritize the successful execution of your trading plan or your trade books over the PnL. Now we’re going to tackle one last principle for building a razor-sharp mental edge, and that is become an expert in bouncing back after losses, setbacks, and mistakes. Why is this principle important? Trading is a very unique profession. What it takes to be successful in trading is very different than what’s required to be successful in other professions. So if you take your old model of what constitutes being a good worker or a top class performance from some other professional arena and you try and apply it in your trading, then you’re actually limiting your potential for success before you ever enter the market. If you’re working off the assumption that you have to avoid losses and finish every day green in order to be successful, then you’re actually setting yourself up to fail. If you consciously or unconsciously believe that losses are a sign of failure and that every day should be a green day, then you’ve likely experienced some of the following: beating yourself up for mistakes and losses, maybe even to the level that it impacts your mood, your relationships, and your life outside of trading, being so unwilling to accept a loss that it leads to revenge trading, ignoring stops, and ignoring daily loss limits.

Being so scared at the prospect of losing money or being wrong that even when you see your A+ setup appear, you hesitate, you second guess yourself, and you fail to pull the trigger on the trade. Being in a winning trade and then jumping out of it too soon because you’re trying to avoid the discomfort and uncertainty of whether it’s going to hit your profit target or whether you’re going to give back unrealized gains. In a nutshell, if you’re trading on the assumption that only winning trades are a sign of success, that losing money on a trade means you’re doing something wrong, and that every day has to be a green day for you to be a successful trader, then you’re trading not to lose as opposed to trading to win. I’ll say it again. You’re trading not to lose as opposed to trading to win. When you’re trading to win, you execute your trading plan exactly as you intended so that you can capitalize on every opportunity that the market is sending your way. And you trust that your risk management is already fully integrated into your trading plan. But I fully understand why you might think that there’s no room for losses and that every day has to be a green day for you to be a successful trader.

Because society and many professions program us to believe that success is constantly hitting targets and achieving goals, and that the more frequently we do this, the more successful we are. Even in school, when we’re younger, we take tests that give us grades that tell us how successful or how not successful we are as a student. So even from this early age, we’re being conditioned to believe that every failure takes us further from self worth, self-esteem, recognition, approval, and even our value as a human being. And social media and trading chat rooms perpetuate this myth. So when traders only post their winning trades, their photos of big houses, fast cars, and their trips around the world, it’s easy to understand why you might think that successful trading means always winning. But this is not the approach that the world’s most successful traders take. They know that in order to be profitable and successful in the long term, they have to be able to accept losses and mistakes like a casino. You don’t see the casino management freaking out, losing sleep, and questioning their ability as managers every time some random punter wins big on the slot machine.

Expecting that every day should be green and that any red day or losing trade is a sign of backwards progress will cause you to lose confidence in yourself, to leave money on the table, to break your trading rules, to tweak your trading strategy constantly to try and achieve a higher win rate. Basically, it will make trading painful instead of profitable. This is what my client, Mike Baehr, was struggling with and the reason why he decided to take up the Go Deep to Level Up Your Trading program. Mike is a former US Marine, and he decided to become a full-time day trader on retiring from the military, and he made great progress in this field. Mike is currently the Chief Training Officer for Peak Capital Trading prop firm, and he’s a performance coach with Bear Bull Traders. Not only that, he has also written some excellent books on trading psychology. So just like Tom, he already had a very good idea of what to do to work on his mental edge. But he hit a very specific block in his trading. He was struggling with the fear of being wrong and also with the uncertainty in the market after placing a trade.

And this block was preventing him from reaching the full level of monthly profit that he knew he was technically capable of reaching. And the block was being exacerbated by his previous conditioning from his military career, where being wrong could have catastrophic consequences. So Mike was conditioned to avoid being wrong at all costs, both from a societal and a professional perspective. He was jumping out of trades too early to avoid the discomfort and anxiety that came with the possibility of losing. By following the Go Deep to Level Up Your Trading system, Mike was able to pinpoint the root cause of these issues in the subconscious mind. And then he was able to use the tools and techniques to shift his thinking and overcome these challenges. And once he did that, he was able to trust himself and his trading plan again and to become much more resilient to the uncertainty inherent in the market. He was able to accept losses, accept the possibility of being wrong, and to authentically buy into the idea that trading doesn’t require people to be perfect in order to be profitable. And the bottom line, he was then successfully able to hold trades until they hit his profit target or his rules told him to get out.

Okay, so you might have been conditioned by society, your upbringing, or your previous employment to believe that success means never losing and never failing. And if you did work in a career like sales or the military, where you were always under pressure, striving to achieve ambitious targets and perfection, then it’s very understandable why you’d be thinking this way. But the awesome thing about increasing your self-awareness and stepping outside of the matrix is that you get to choose the beliefs that you program your mind with. So even if you’ve heard it 10,000 times, that being wrong is a sign of failure or that losing means you’re not making any progress, you get to choose to reprogram how you think about success. And what I really want you to understand from today’s training is that the world’s most successful traders don’t think like this. They understand the trading job description, and they know that embracing imperfection and losses is a necessary ingredient for consistent profitability. Steve Cohen of Point 72 Asset Management said in the book Stock Market Wizards, I compile statistics on my traders. My best trader makes money only 63% of the time. Most traders make money only in the 50 to 55% range.

That means you’re going to be wrong a lot. And if that’s the case, you better be sure that your losses are as small as they can be and that your winners are bigger. You don’t need to be perfect in order to be profitable. Statistically, you don’t even need to win every trade. So who’s tricking you when you’re in the market feeling triggered by a loss or a missed opportunity? It’s our old friend, the subconscious mind. And all of the beliefs and associations that you hold about what it takes to be a successful trader. One loss or one red day will likely not have any significant long lasting impact on your trading account if you’re following your trading process. The problem starts after that loss or red day. What do you do next? Do you compound the issue by going on tilt? Do you change your strategy for the 15th time because you’re starting to doubt your plan again? Or do you calmly reset to neutral and follow your trading plan? It’s the cumulative effect of repeatedly breaking your trading rules that poses a threat to your trading account and your long term success. Not imperfection, a mistake, a loss or a red day.

Our human psychology wires us to be oriented towards loss aversion, and this causes a lot of traders to strive for high win rates or to even choose strategies with high win rates so that they can feel successful. But in reality, the actual skill to be mastered is how to become so resilient under the inevitable pressure of losses, setbacks and mistakes that you can carry on and stick to your trading plan regardless. That is where the real money can be made. If you did the maths on your strategy, you would probably find that there are a certain number of red days that you can tolerate and still be profitable at the end of the month, as long as you’re sticking to your trading trading plan. So let’s imagine that you’re a hedge fund manager and you’re writing the job description for the traders who will work at your firm. Are you going to hire traders who are so concerned with avoiding being wrong, losses and mistakes that they constantly self-sabotage and break their trading rules? Or are you going to want to hire the trader who maybe has a lower win rate, who might have multiple losses, but who ultimately makes a ton of money for the firm because they always stick to their trading plan?

Are you going to want to hire someone who’s trading not to lose or someone who’s trading to win? The bottom line is that you do not need to be perfect in order to be profitable, but you do need to stick to your trading plan and you do need the skill of bouncing back like a rubber band after losses. This may require a deep identity shift, moving from someone who embodies a fear of losing, of being wrong, and perfectionist tendencies that sabotage your trading, and stepping into the identity of someone who is fearlessly unshakably committed to executing your trading plan. Replace your old outdated beliefs around success and achievement, and upgrade your thinking with a logical rational assessment of what it takes to be a successful trader. Write your own trading job description. Let that be the job description that you seek to deliver on every time that you trade. Forget ego trades, forget social media, forget other people’s perceptions of your trading. Let that be the measure of your success. So now we’ve wrapped up our short tour of how to apply three principles from the Go Deep to Level Up System to your trading to achieve measurable results.

We’ve covered how you can eradicate strong emotions from your trading and resolve indiscipline and breaking your trading rules at the very root using the Go Deep to Level Up framework. We’ve covered why detaching from the PnL is so important and some practical techniques that you can use to focus on the successful execution of your trading plan instead. And we’ve covered how to challenge everything you’ve ever known about success and losses and how to create a new belief system that defines trading success in the way that the world’s most profitable traders do. So can you see how making these small mindset shifts, combined with implementing practical tools in your trading, can save you time, emotional capital, and money? Today, I’ve covered as much as I possibly could, and I’ve given you some practical tools and techniques that you can implement right off the bat in your trading. Hopefully, you’re already starting to see how leveraging this mental conditioning system can accelerate your path to elite level execution and consistency, and most importantly, making more profit. And just to be crystal clear, this system is not just for retail day traders who are looking to pass evaluations and get funded with prop firms.

Although, of course, it can help with that. This system is also used by professional hedge fund traders seeking to optimize their execution under pressure. François Gerber is a great example of that. He used this system to break through an asset threshold ceiling and achieve a sharp ratio above two. Now, here’s the thing. I said at the start of this training that one of my goals was to inspire you to take action to start working on your mental edge. Because passively consuming this content and nodding along as it hits a nerve and it resonates with you is not going to change anything in your trading. That’s as effective as sitting on the couch eating potato chips while watching fitness videos. Transformation comes from implementation. So what’s next? If the content didn’t totally resonate with you, if you feel that your trading is good enough as it is, or if you would prefer to dabble in DIY trading psychology fixes, then this is your off-ramp for this training today. I I hope that you’ve taken some valuable insights from it that will be thought-provoking for your trading. However, if you’re feeling hopeful, motivated, and in any way curious to find out what it takes to make a transformation like Tom, Meleen, Mike, François, and Lisa, then stick with me for the next few minutes.

I’m going to walk you through the exact process that they followed and explain how you can access this system today so that you don’t waste another day paying the market instead of yourself. And so I am so excited to formally introduce you to Go Deep to Level Up Your Trading™. This is your all in one system to fix what’s not working in your trading, but also to propel you to elite level discipline, execution, and consistency. This is your all in one system to shortcut through your psyche and decode and resolve all of the limiting subconscious beliefs, the subconscious patterns, and the self-sabotage that have been holding you back until now. I wanted to create a trading psychology solution that focuses on quality, efficiency, and results, not motivational fluff. And so I’ve taken my almost two decades of performance coaching experience and distilled this down into the exact topics that you need to know and the exact tools that you need to put in place to do this. And this efficiency is how my clients are getting measurable results in as little as eight weeks and sometimes in an even shorter time frame. Go Deep to Level Up Your Trading™ is an eight module online program that’s designed to give you a razor sharp mental edge, a world-class personalized mental training routine and to put you firmly back in the driver’s seat of your trading so that you never succumb to impulsive or emotion-based trading again.

This is not an online course where you passively watch some videos and you’re left to your own devices. And it’s not a program that you dive into for eight weeks and then you hope that your trading changes by osmosis. It’s a mental conditioning system designed to pay dividends in your trading for the rest of your trading career. That’s why it includes education to help you understand exactly how your psychology is influencing your trading and how to take control of that. It’s why it includes personalization to help you apply these concepts to your own trading in a way that mirrors the effectiveness of one to one coaching. And it’s why it includes a blueprint for implementation, because without consistent action, nothing changes. I’ll be honest, this isn’t for beginner traders. I’m not here to try and convince you that trading psychology is important for your trading. If you’re still watching, you already know that. And I’m not here to handhold self-deceiving traders who are looking to outsource their accountability and results. I’m holding space for the serious traders who are willing to do what it takes to succeed, the ones who don’t just want the solution that makes them feel productive, but that actually delivers measurable improvements in bottom line performance.

So if that’s you, an experienced trader who’s still battling inconsistency, over trading, performance slumps, or emotional execution, and you’re ready to fix it, here’s what I want you to do. Book your Program Fit Call with me on Zoom. This is a private 30 minute one to one where we’ll discuss where your mindset and execution are holding you back, and what you want to achieve in your trading. I’ll walk you through how Go Deep to Level Up works and how the system can be applied to your specific challenges so that you can decide if it’s right for you. I’ll also talk you through the program structure, the workload, the two pathway options and the investment so that you can get crystal clear on what to expect if you do decide to enrol. To book your call, click on the link that’s appearing now on your screen. You’ll fill out a short application form. It takes less than two minutes to fill in, just so that I know that I’m in a position to help. And if that’s the case, then you’ll be taken to a scheduling page right away where you can book your call. Why give my time like this?

Because I fiercely believe in this program and I want every trader who enrolls to see success. So I don’t want impulse buys. I want traders who are committed to the process and ready to hit the ground running from day one. But I do only have capacity for a limited number of these calls each month. And priority goes to those traders who I feel I’m best positioned to support. So if this resonates, don’t sit on it. Take action now and apply to book your Program Fit Call before the opportunity expires. Okay, that’s what I’ve got for you today. Thank you for joining me. And I hope that you’ve gained some really valuable insights for your trading. And if you do decide to book that call, I’m looking forward to speaking with you very soon.

Trader Perspectives on Go Deep to Level Up™

Testimonial Disclosure: Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.